A Taxing Situation

Everyone believes that they give more than enough to Uncle Sam and are reticent to voluntarily give any more. Quite often, we come across a situation where a client has an outsized position in one or several stocks and they won’t sell any because of the tax implications, even if the long term capital gains rate is the most reasonable rate.

We get it, but sometimes, it can make quite a bit of sense to take some of those sizable positions down to more manageable levels. Here is some food for thought.

- Nothing lasts forever, and usually it lasts less than ten years.

Maybe you were lucky enough to own some NVIDA (NVDA) stock before it took off, and here you are with some impressive gains in your portfolio. What do you do now?

The lessons of the stock market are clear. The leaders of one decade are rarely the leaders of the next decade or the one after that. Back at the turn of the century, Cisco (CSCO) was the one stock you simply had to own. It had a seemingly unassailable market position and appeared poised to ‘grow forever’. That didn’t last long. By 2010, Cisco was only a little bit more than an afterthought. Don’t get me wrong, Cisco is still a fine company, but it was never going to maintain its dominance over the long term. Nothing ever does.

Back in the 60’s and 70’s, IBM (IBM) was the technological leader. It held what appeared to be an unassailable position in the computing market. Again, IBM is still a fine company, but it could not hold onto that market dominance. The tech leaders of today are no different. At some point they will also fall by the wayside as new competition comes in and/or new technology advances are made to limit their dominance.

There is nothing wrong with systematically selling down that large position and taking some gains even if it means paying some taxes, and in fact, you can offset those gains with some other losses to make it more palatable.

- I’ve owned this stock forever, and I missed the top.

Or maybe a relative left you some stock long ago that you never sold, it went up a lot, but it is far from its peak. What are you supposed to do?

Here’s an example, you inherited some Gilead Sciences (GILD) from a relative 10 years ago, GILD traded at $120 in 2015, but it’s only $65 now. If you had sold for even $90 you would have kept more than $65 after taxes and used that money for a better investment. You can’t sell at $65, can you? Yes, you can. Maybe it will come back, maybe it won’t, but if the stock is down that much, the bloom is off whatever rose it had when it traded at $120. Where it traded in 2015 is irrelevant. You have to deal with the present.

- Tax rates are NOT permanent.

The capital gains rate is 20% today, but the U.S. is running very large deficits and unless Congress decides to cut spending, they are going to have to increase taxes, especially on the wealthy. That places the capital gains tax directly in the crosshairs of tax policy in the coming years. Imagine a day when suddenly the capital gains rate is increased to 40%. You’re going to wish you had taken those gains when the tax rate was lower.

Yes, we will agree that it is more likely that any change in the capital gains rate will not be made retroactively, although retroactive changes have been made before. Even if the change isn’t retroactive, there will be a rush to the exits to take those gains before the new law goes into effect. Stock prices won’t react positively to that news.

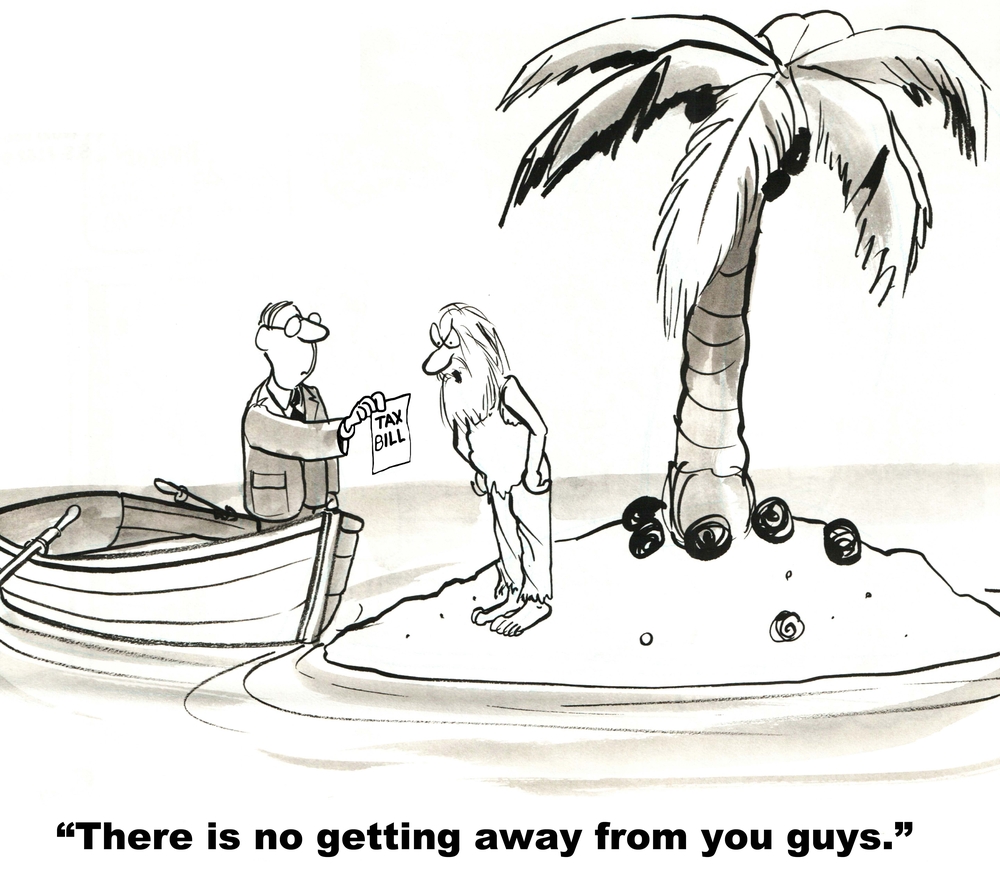

Our point is that you should not agonize over taking some profits. Once you do, at least you know what is yours and are free from the tax man. Systematically taking profits on large positions also allows your overall portfolio to be best positioned for your situation and will probably reduce the overall risk inherent in your portfolio. Paying taxes is never fun, but sometimes, it just makes sense.

Have a great week!

What We’re Reading

The Copper Opportunity in One Chart

Milton Friedman on Capitalism vs. Socialism (3 min. video)

An art market full of cracks is about to face a $1 billion test

The effect of the job market on the economy

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Capital Gains Taxes, General News, Income Taxes, Stock Market, Taxes, Tech StocksBy: thinkhouse