How We Help You

This begins with our clients sharing with us their vision for their life and our responsibility is to make it a reality.

Our 50 plus year research study that gives us the edge we need to assist our clients in accomplishing their vision.

Working with BNY Mellon’s Pershing gives our clients the comfort to know their money is protected with a world class financial institution and we provide conflict free advice as legal fiduciaries.

THE PWM

WEALTH MANAGEMENT FORMULA

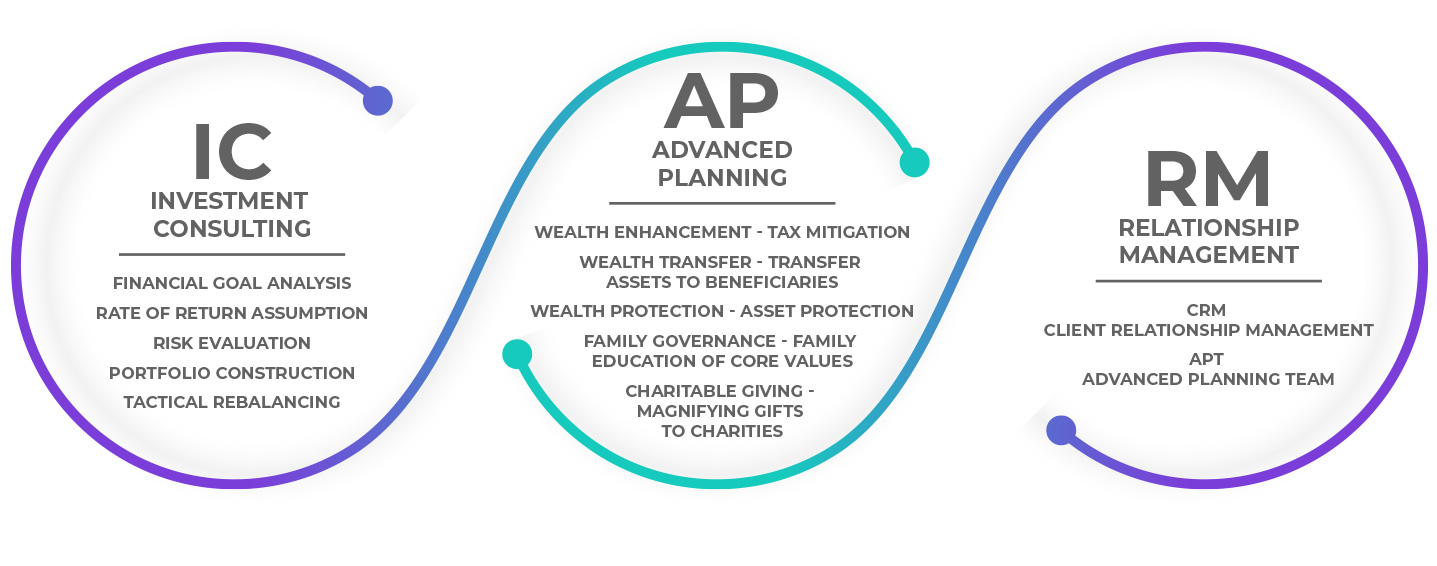

Our time-tested formula is designed to take the complexity of wealth management and break it down into simple language that our clients can easily understand. We want to review not just your investment plan, but every aspect of your life that has to do with your wealth.

THE PWM

5-STEP CONSULTATIVE PROCESS

Our Wealth Management Consultative Process employs a comprehensive series of steps to uncover any gaps that our clients may be exposed to as it relates to their life and financial goals.

OUR EXPERIENCE

With more than 100 years of combined experience, we have earned the industry’s most respected credentials from the Chartered Financial Analyst Institute, Certified Financial Planning Board and Masters of Business Administration from private Ivy League Universities.

WHO WE SERVE

FAMILIES

INDIVIDUALS

PROFESSIONALS & ENTREPRENEURS

Palumbo Wealth Management assists select families and individuals who are nearing retirement or are currently retired as their personal chief financial officer (CFO). A large number of our clients are dentists, physicians and business owners.

HOW WE COMMUNICATE

STRAIGHT TALK is a core value of our practice and it is the foundation for building strong, healthy relationships for years to come. This is what we promise you. However, our philosophy is to go ABOVE AND BEYOND. Our door is always open if you need to speak with us or meet in person.

6/4/2

Bi-monthly calls to check in, provide quick updates and discuss a financial planning theme, Quarterly reviews, Two face-to-face meetings

PWM’S

Observations newsletter delivered weekly to your e-mail

Direct

phone calls, e-mails and conference calls during volatile market periods

Quarterly

market update conference calls

Annual

investment event

Special

educational events throughout the year

Guest

speaker events

PWM SERVICES

Palumbo Wealth Management offers our clients a range of services that focus on wealth enhancement, tax management and cost savings; wealth transfer to a surviving spouse and to the next generation of family members; wealth protection using insurance and portfolio strategies; and charitable giving strategies to maximize the power of gifts. The wide array of services we offer, either through work with our Advanced Planning Team or the services provided by BNY MellonI Pershing, include:

PERSONAL CHIEF FINANCIAL OFFICER

We operate as your personal chief financial officer (CFO), your “go-to” person for any financial need you might have. We will guide you and your family to the right decisions not only for your investments, but also on your tax mitigation opportunities, estate and trust planning, family governance, asset protection, long-term care planning, Medicare, Medicaid and Social Security planning, and your philanthropic goals. We believe strongly that serving as your personal CFO will take the burden off your shoulders of you managing every piece of your financial life, thus freeing you to live your best life during your retirement years.

Provide a detail plan to assist you in understanding income sources, if you have enough money saved and probability of being able to retire on your preferred timeline.

When it comes to investment planning, our process is logical and deliberate. It was chosen to fit with our clients’ objectives: to create and maintain peace of mind regarding their investments.

We understand that rates of returns used in financial planning are only forecasts. Nobody can tell you with certainty if the returns will be achieved or not over the lifetime of the plan.

Furthermore, we do not believe anyone can consistently time the markets and/or predict the direction of interest rates and the economy, which are unknowns.

Our approach is to control what we can control. Through the use of sophisticated technology and our disciplined 50-year research analysis using our RISK-BALANCED ALLOCATION approach, we work with our clients to arrive at the most appropriate solution for their financial needs and balanced by their risk tolerances. There are two main steps to our process:

- First, we work to understand if our clients can achieve their financial goals using forecasted returns of highly conservative portfolios constructed around a well-documented, disciplined investment strategy.

- Second, we invest using this well-documented, disciplined approach, which has shown over time to provide more than double the conservative returns used in the first step.

This highly DISCIPLINED approach assists in providing you with a broader perspective and better understanding of the ramifications of your investment decision-making, thus offering you what we believe to be the highest probability of achieving your financial goals over your lifetime.

Use strategies to maximize the tax efficiency of current assets and cash flow, while achieving both growth and preservation goals.

With our strategic partners, we summarize your existing estate planning structure and identify gaps that can expose your family to unnecessary taxes.

Analyze your financial exposures and risks if you were to get sued, suddenly passed or had a long-term illness.

Assist in using strategies to maximize the effectiveness of your charitable and philanthropic intent.

As part of our family governance philosophy, we strive to ensure that your heirs are properly cared for when you pass on. We will work to see that your assets are passed on according to your wishes and that your children and grandchildren are properly educated about money. That way, when the time comes to carry on your legacy, they will be fully prepared.

Through our strategic partners with the world’s largest financial institutions, we can manage all banking needs to assist you in managing cash flow and liquidity requirements.

Technology continues to evolve quickly and clients want to easily monitor their financial and investment plans. For these reasons, we have partnered with Envestnet | Tamarac which has been sharply focused on innovating and building one of the leading technologies for more than 20 years. Tamarac’s technology offers you a comprehensive solution to deliver strength in how you track your progress with us. Tamarac provides you with the necessary tools to:

- Monitor your investment performance daily using Tamarac’s client on-line portal and mobile app

- Review your portfolio value for any specific day

- Interact with portfolio reporting to generate customized reports in PDF format

- Use Document Vault to hold your most important documents all in one place

- Create and manage personal budgets

- Review your financial plan that we build for you

- Connect outside accounts for a Total Financial View

Through this technology, we can provide you with cutting-edge reporting, portfolio management and client engagement technology to create a world-class digital experience.