Bet You Didn’t Know

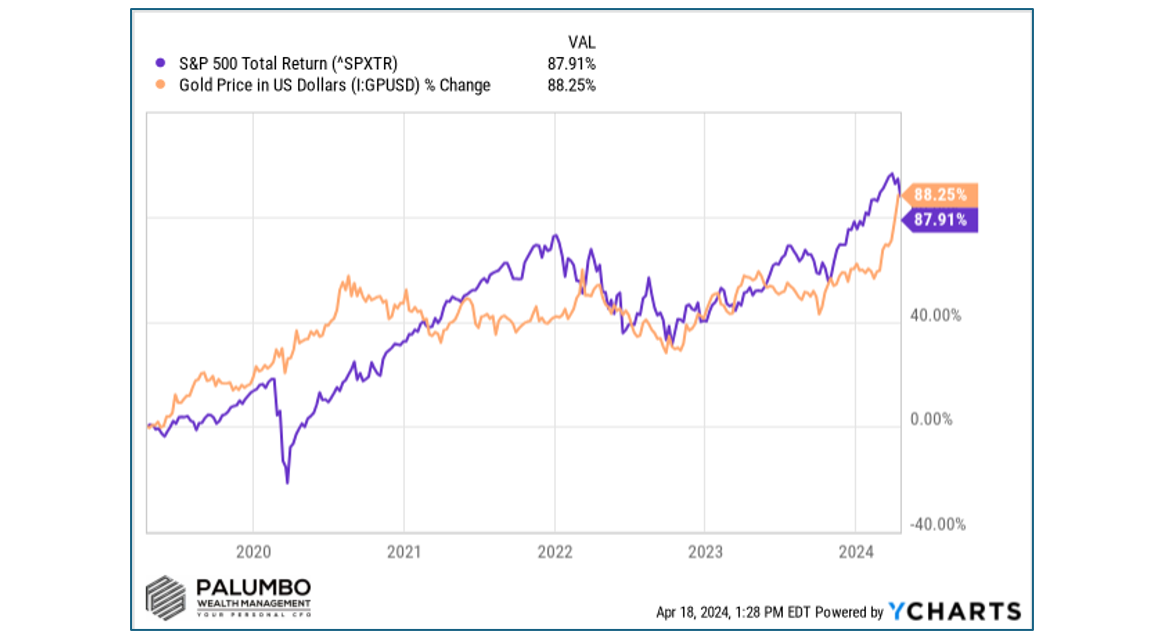

With all the attention on the stock market, we bet you didn’t know that over the last 5 years, gold has outperformed the S&P 500!

The recent very strong performance of gold is very unusual. What’s driving this unusual occurrence? We see it as:

The Good, The Bad and the Ugly

If our picture this week is not familiar, then you have never seen the iconic film which is the source of our title this week. It’s the film that made Clint Eastwood famous and is a worthy watch for any movie buff. The reason for stealing the title is that we see three things that together are influencing markets.

In this case, the Good is gold, the hard currency that is very much in demand around the world. The Bad is the beat of War. Ukraine is a continuing issue, the Middel East is an emerging issue and Taiwan is a potential issue, all with difficult ramifications for the US economy. The Ugly is the US Dollar that is experiencing eroding global influence. These three are not independent items. They are entwined with each other and feed off each other. Allow us to attempt to explain in simple terms.

The Good

Gold has been used as money for thousands of years and although there are no more gold coins or major gold backed currencies, gold remains a mainstay of the global monetary system because it is one of the key reserves central banks use to support their own fiat currencies. Gold is a hard currency, as opposed to fiat currencies, like the dollar or Euro. Gold resources are finite, whereas countries can print as much fiat currency as they desire.

Central banks like to diversify their monetary reserves and in addition to gold, will hold other currencies that they consider ‘safe’, primarily the dollar, but also Euros and Yen. What has been changing is that Central Banks have been big buyers of gold lately, in particular, China and Russia. After the invasion of Ukraine, Russia was hit with sanctions from the U.S., designed to limit Russia’s ability to transact in global markets (most markets, including oil, are priced in dollars). Russia responded by linking the ruble to gold, which now underpins the currency as the country continues its attempts to de-dollarize, that is, transact in currencies other than the dollar. To the extent de-dollarization is successful, it limits the effectiveness of any U.S. sanctions.

China, which owns about $775 billion of U.S. Treasuries as reserves, is working this total down as they grow their own gold reserves. China is also vulnerable to U.S. sanctions which is a major deterrent to ‘re-uniting’ Taiwan with China. If there is to be a conflict over Taiwan, China will also desire to be as ‘free’ from the U.S. dollar as possible, so we expect this de-dollarization trend to continue, which helps drive demand for gold.

The Bad

War, and the threat of war, is creating additional political discontent, and is creating enormous human suffering already. However, our emphasis here is economic. War is pushing our already large fiscal deficit even higher and stretching U.S. resources and supply chains. The Middle East could be on the cusp of accelerating into a regional conflict. China and the U.S. continue to play cat and mouse in the South China Sea over the fate of Taiwan. Both of these would stretch U.S. resources that much further adding trillions more of debt through larger fiscal deficits.

Foreign countries own about one quarter of US debt and China represents about 20% of that. As U.S. debts mount, the willingness of foreign countries to continue to buy Treasuries could come into question. The weaker the U.S. appears, the less likely they are to buy more of our debt. In short, there are limits to the amount of debt we can sell and wars will test those limits. However, we would be best not discovering where those limits are.

The Ugly

The bottom line is that the Global East generally desires to de-dollarize and China and Russia are leading the charge. We are at a point in time, where we cannot afford confidence in the dollar to decline, but if the U.S. continues to layer on trillions and trillions in new debt, that is exactly where we are headed. While we have a powerful military, our economic power has been what has kept the U.S. in a leadership role and that role is under attack. Fiscal restraint, balanced budgets, thoughtful reworking of Social Security and Medicare could go a long way to keeping the dollar as the ‘currency king’. BY the same token, potentially fighting/supporting three wars pushes us along the way toward ever increasing debt levels and falling confidence in the dollar.

Warning Signs?

The signs are already beginning to appear. The most obvious is that gold, the yellow metal that pays no interest or dividends, has rallied to new all-time highs at a time when real interest rates (the interest rate above inflation) is quite high. This is not normal price action. If history were any guide, the price of gold should be declining when real rates are so high.

Also, this week the IMF (International Monetary Fund) chastised the U.S. in the latest World Economic Outlook stating:

“The exceptional recent performance of the United States is certainly impressive and a major driver of global growth, but it reflects strong demand factors as well, including a fiscal stance that is out of line with long-term fiscal sustainability. This raises short-term risks to the disinflation process, as well as longer-term fiscal and financial stability risks for the global economy since it risks pushing up global funding costs. Something will have to give.”

Both markets and outside observers are flashing potential warning signs. The canary in the coal mine will likely be the dollar. A steady dollar decline would be indicative that the limits, wherever they are, have been reached. If the dollar begins to decline steadily, it will be time to consider increasing gold positions and maybe even consider taking a position in bitcoin.

What We’re Reading

Something strange has been happening with jobless claims numbers lately

High company valuations a ‘worry,’ IMF’s capital markets chief says

Iran and Israel’s War Comes Out of the Shadows

China downsizes holdings of US treasury bonds to $775 billion

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

budget deficit, China, Dollar, Federal Debt, General News, Gold, Russia, US DollarBy: thinkhouse