What, Me Worry?

The Federal Open Market Committee (FOMC) held their meeting this week and as usual, it created some wild swings on Wall Street. What caused the ruckus this time was a market that had been leaning toward fewer and fewer rates cuts and some early chatter about maybe the next move had to be an increase because inflation was increasingly sticky. That sticky inflation was causing many of us old timers to consider stagflation as a possible outcome, which is something the U.S. has not seen since the late 70’s/early 80’s. (A recent World Bank report defined stagflation as a combination of high inflation and low growth or high unemployment.)

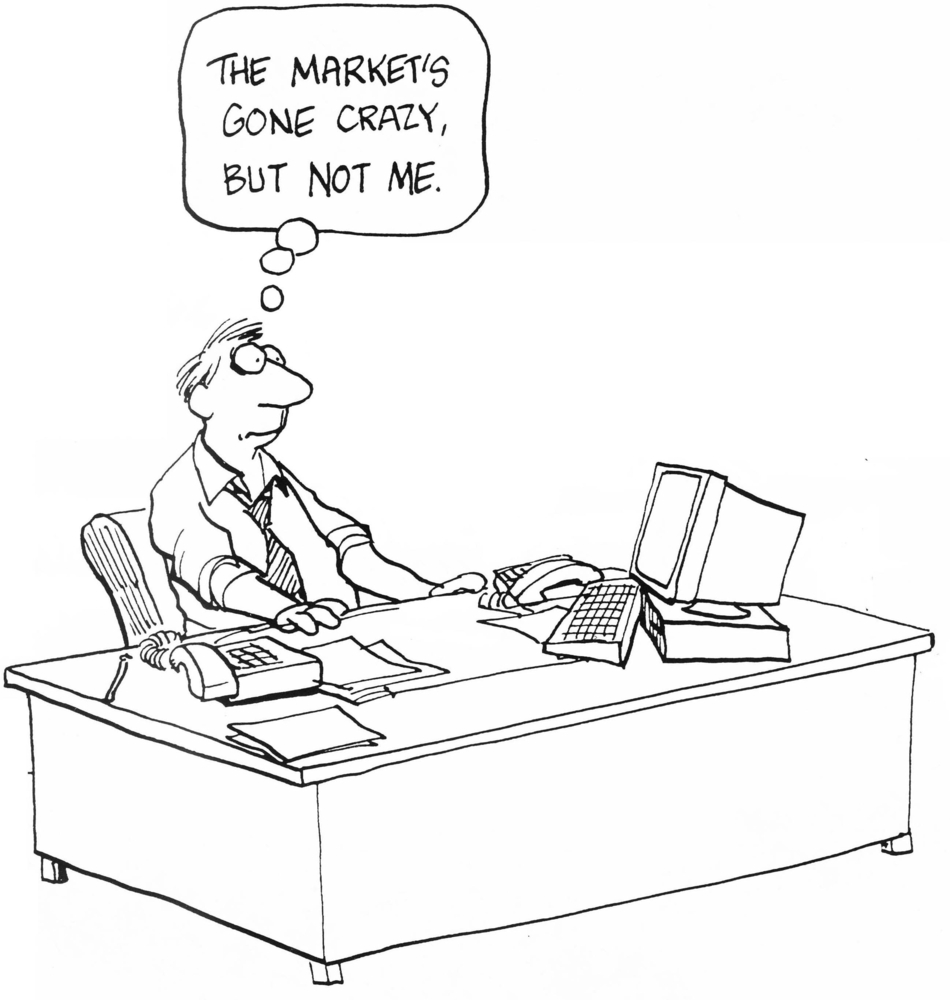

What set the market rising was Powell’s comment at the press conference that discounted stagflation. “I was around for stagflation and it was 10 percent unemployment, it was high single digits inflation, right now we have… 3 percent growth, which is pretty solid growth I would say, by any measure, and we have inflation running under 3 percent. So, I don’t really understand where that’s coming from… so I don’t see the ‘stag’ or the ‘flation’ actually.” His message was loud and clear…. I’m not worried.

Financial markets often overreact to news and we suspect they did once again. Chair Powell is absolutely correct that the current situation has little resemblance to the 1970’s, we would counter that stagflation does not need to look like the 1970’s either. Below trend growth and above trend inflation would fit our definition. At the moment, we are NOT there, but recent data has brought us stickier than expected inflation and some evidence of slowing growth. That raises the level of concern, even if it is not a base case for the economy.

Many would argue who are we to question some of the brightest economists on the planet and that is a valid argument. Our counter is that these same economists missed the inflation in the first place and then reacted to it very slowly, which has brought us to the difficult economic situation we have today. The Fed’s job is not easy, even for the best and the brightest. Nonetheless, markets will move with the Fed simply because traders are now convinced that not only is a rate increase off the table, at least for now, but that implies rate cuts are still coming. As we have said before, we look for the rates to be ‘lower, but slower’. For now, that is all the stock market needs to renew a rally.

Have a great week!

What We’re Reading

Americans Continue to Name Inflation as Top Financial Problem

Trump leads Biden in major battleground states

Long-predicted consumer pullback finally hits restaurants like Starbucks, KFC and McDonald’s

Problems with Glen Canyon Dam could jeopardize water flowing to Western states

Here’s where the jobs are for April 2024 — in one chart

Palumbo Wealth Management (PWM) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where PWM and its representatives are properly licensed or exempt from licensure. For additional information, please visit our website at www.palumbowm.com.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward‐looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

Economic Growth, Federal Reserve, General News, Inflation, Interest Rates, Jerome Powell, S&P 500, UnemploymentBy: thinkhouse